Payment Processing for Nonprofits

What Is Nonprofit Payment Processing?

Nonprofit payment processing, also known as credit card processing or an online payment system, is the processing of donors’ financial information whenever they make an online transaction with a nonprofit organization.

Any nonprofit that relies on online fundraising will need to have a payment processor to collect donations online. For small to midsize nonprofits, online donations make up between 7.8% and 13.4% of total fundraising, so it’s important to give supporters a way to make their contributions online.

Nonprofits also use payment processing for other online purchases, like merchandise sales, event registration, and membership fees.

Online payment systems work with donor management systems to capture donors’ payment information and collect payments. Nonprofits use online payment systems to securely accept payments online.

Understanding Payment Processing

When you’re looking for a new payment processor or just trying to understand the one you have, there are a few terms and concepts that are important to be aware of:

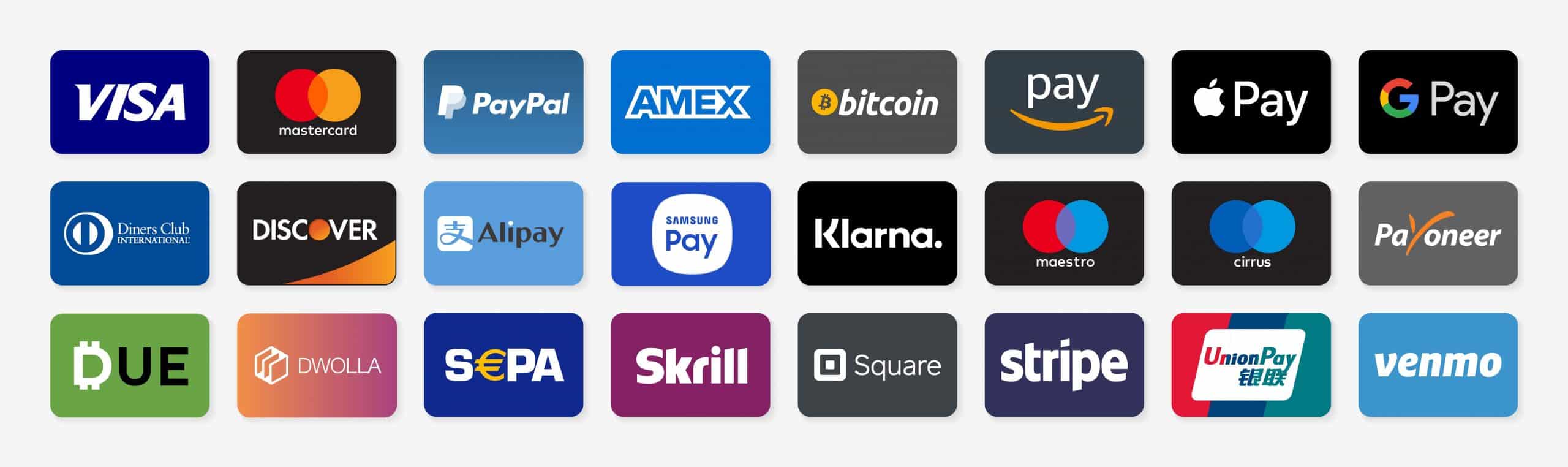

Payment forms accepted

Have you ever noticed that some stores post credit card company logos outside on their windows? The stickers indicate which forms of payment can be accepted at that location. That’s because each payment processor takes different kinds of payments. Even though many of your transactions may happen online or at an event venue, you’ll still need to be aware of which forms of payment your processor will be able to accept.

Do you only need the major ones like Visa, Mastercard, and Discover? What about Apple Pay or Venmo? Check and make sure your credit card processor is meeting the needs of your organization and donors.

Payout time

For most payment processors, you won’t have access to your funds immediately. That’s because they don’t go straight into your bank account. The funds will either be manually deposited into your account, or you can set up an automatic deposit schedule. Once the funds begin to transfer over, they can become available as quickly as the same day, or it may take as many as five days.

If you need to have quick access to your funds, consider a solution without a low deposit delay or one that has an instant payout feature.

Point-of-sale transactions

It’s likely that today, many of your transaction happen online through your website or donation page. But there are likely other scenarios where you’ll need the ability to accept donations or other transactions in-person like a silent auction or other nonprofit event.

Point-of-sale transactions allow you to collect payments in-person like a store or business. They typically require hardware like a credit card reader to complete the action, and there may be additional fees involved. Make sure your payment processor can accommodate in-person transactions if you need the ability to collect transactions in-person.

Keep in mind that you can always utilize mobile fundraising tools like text-to-give and mobile friendly donation pages to collect donations on-the-go without additional hardware.

ACH

ACH stands for automated Automated Clearing House. It’s a way for payment processors to transfer money directly to and from a bank account using a routing and account number. While most payment processors will use a system like ACH to transfer your funds to your bank account, not every one will allow you to collect donations using ACH.

Some nonprofits prefer to offer ACH as a payment method to save on transaction fees, plus you don’t have to worry about updating card information. If it’s important to offer your donors this option for their donations, check and make sure your payment processor is capable of this.

Transaction or processing fees

Almost every payment processor will charge you a fee to process each transaction or donation. Usually the fee is a percentage of the total transaction plus a flat rate. For example, there might be a 2.9% + $0.30 fee. That means for each transaction, your payment processor will take 2.9% of the total transaction plus an additional $0.30.

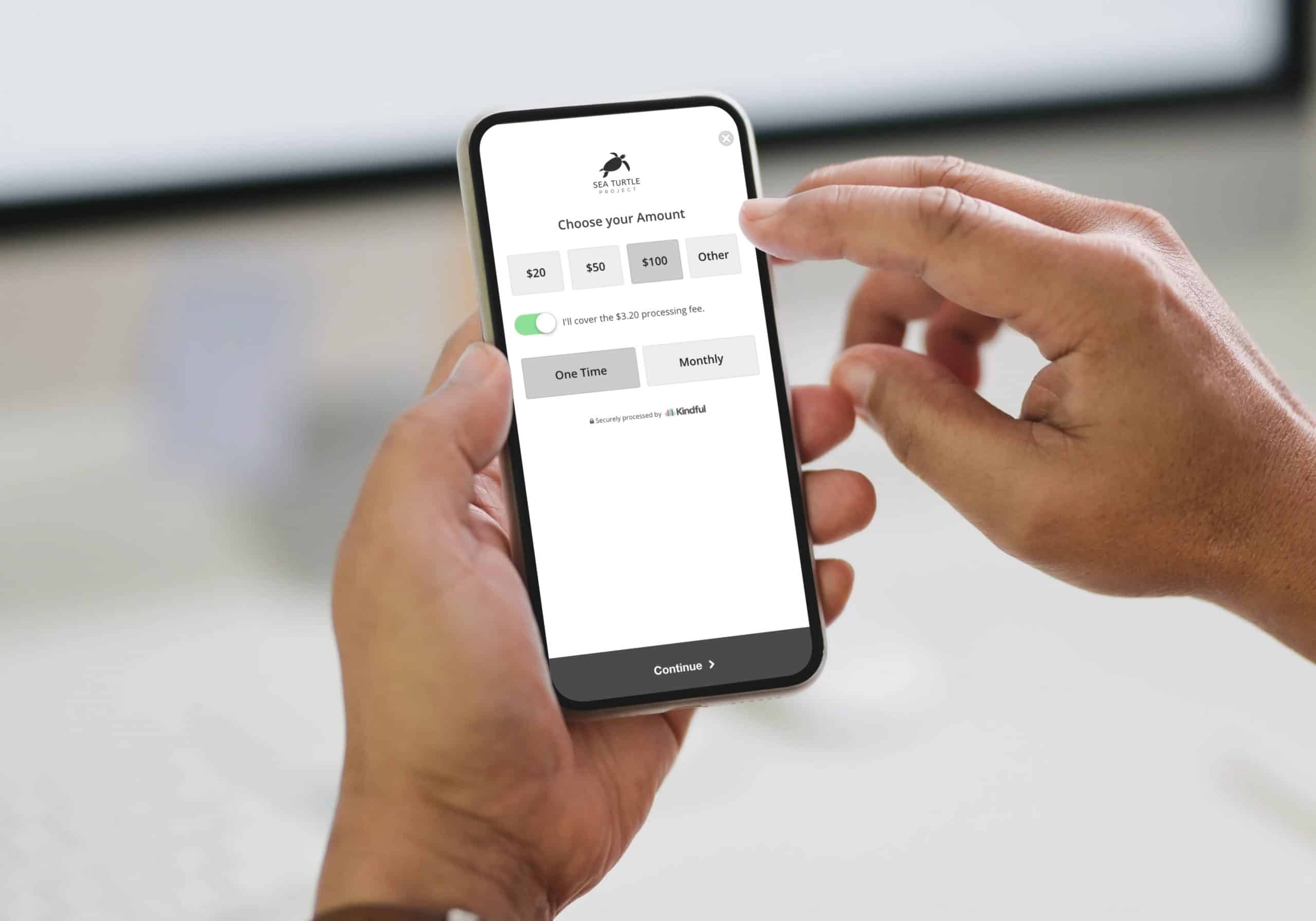

Transaction rates can take away valuable revenue for your nonprofit, so make sure you do your research and find the most affordable rates. The good news is that many payment processors give nonprofits a special discount. Some online fundraising tools also give your donors the option to cover the transaction fee as part of their donation.

How To Choose A Payment Processor

Choosing a payment processor for your nonprofit is an important task. For your donors, you want to provide an online donation experience that’s secure and trustworthy. For your organization, you likely want to choose a payment processor that’s affordable, flexible, and integrates with your current systems.

Here are some considerations to keep in mind when looking for the best nonprofit payment processor.

- What special features, if any, do we need?

- What payment forms are accepted?

- Do we want to offer special donation options like ACH, Apple Pay, or Google Pay?

- How long does it take to get donations deposited to our account?

- Do we need to be able to accept transactions in-person?

- What are the fees? Is there an option to have our donors cover the fee?

See The Best Payment Processors For Nonprofits

Is There Free Credit Card Processing For Nonprofits?

Almost all credit card processors charge fees to process your donations. Stripe, PayPal for nonprofits, Square, Authorize.Net, and Bloomerang Payments all require processing fees for transactions. But one way to get free credit card processing is by asking your donors to pay for the fee themselves. One nonprofit reports that over 75% of their donors choose to cover their transaction fees, saving the organization $6,000 a year.

Check with your donor management and online fundraising platforms to see if this option is available on your donation forms. Then, make sure it’s enabled. You’ll likely find that the majority of donors are willing to donate the cost of your credit card processing fee.

Bottom Line

Nonprofit payment processing is an essential part of any nonprofit organization. Providing donors with a secure, easy-to-use payment system will ensure their donation experience is a positive one.

Related Resources

- PND article: Online Giving Increased 1.2 Percent in 2018, Report Finds

- Double the Donation post: The Beginner’s Guide To Payment Processing

*Indicates the organization is a Kindful integration partner.