How to write a compelling donation acknowledgment letter

Donor retention in the nonprofit sector is on the slide. 2024 Fundraising Effectiveness Project data shows donor retention was down 4.6%, “the fourth consecutive year where overall donor retention rate has decreased YOY.”

Luckily, nonprofits have a simple retention tool in their pockets that they can leverage without breaking the bank: donation acknowledgment letters. According to donor experience research, timely thank-you messages are one of the top reasons supporters keep giving to nonprofits.

A donor or donation acknowledgment letter is a letter that nonprofits send to thank donors for their gifts. As we’ll discuss below, it’s also an opportunity for you to provide the official documentation required by the IRS to donors who have given a gift over $250.

This guide to donation acknowledgment letters covers the following key points:

- Donation Acknowledgment Letters: FAQs

- How to Write Inspiring Gift Acknowledgment Letters

- Free Donation Acknowledgment Letter Templates

- Automate Donation Recognition Letters with Your CRM

We recommend sending a donation thank-you letter every time a donor gives. This lets you express gratitude for donors’ support, share your progress and future goals, and ensure they know you received their gift.

Donation Acknowledgment Letters: FAQs

What is a donation acknowledgment letter?

A donation acknowledgment letter is a type of donor letter that nonprofits send to document donors’ charitable gifts and donations. Sometimes your donation receipt functions as a donor acknowledgement, but this is not always the case.

All donors deserve to be thanked, no matter the size of their gift. Utilizing donor acknowledgment letters allows your donors to confirm receipt of their donation, keep a record of their contributions, and build rapport with your nonprofit.

While we recommend sending donation acknowledgment letters to all donors, you are legally obligated to send documentation to donors who have given a gift of $250 or more. The IRS requires nonprofit organizations to provide a formal acknowledgment letter to these donors for tax purposes.

Why should you acknowledge your donors?

Besides the legal requirements, donors shouldn’t wonder if their donation was received. Your nonprofit should quickly follow up with gift confirmations and gratitude messages to start building longer-lasting relationships.

Check if your email marketing tool or nonprofit CRM software allows you to automate your acknowledgments. To make this process as easy and impactful as possible, create an email template that confirms the donation as soon as the donor’s payment has been processed on your donation page.

You should also be able to segment your donors into different lists based on different actions the donor has taken. For example, you could set up an automatic report that pulls a list of donors who have given more than $250 to your nonprofit. You could then pass that list to a board member to make personal phone calls to acknowledge the donors’ gifts.

Do you have to send an acknowledgment letter for every donation?

You’ll likely have some donors who make multiple contributions of $250 or more throughout the year. So, do you need to send multiple acknowledgment letters to the same donor?

According to the IRS, you can send an acknowledgment letter for every contribution or one acknowledgment for all of the donor’s contributions in one year. It’s up to you which method you choose.

We recommend sending a year-end acknowledgement letter to your donors, even if you sent separate ones for each donation. Why? It’s when your donors will collect the documents they need to file their taxes. They may struggle to find them if they made three or four contributions throughout the year. That means they may reach out to you and request a complete summary of their charitable contributions for the year.

Sending your donors a year-end acknowledgment or tax summary letter will save you and the donor time.

When is the deadline for sending donation acknowledgments?

Technically, the IRS doesn’t set a deadline for sending donation acknowledgments. But that doesn’t mean you have as long as you want to send them out. Most organizations aim to send their donation acknowledgment letters by January 31 of the year following the donation.

There are two factors to keep in mind regarding your timing. All your donors will need their tax acknowledgments before the federal tax filing deadline in April. While some donors may get extensions to file taxes, you don’t want to count on all your donors getting that extra time.

Most of your donors will file their taxes before the deadline, some as early as February. That’s why most organizations are proactive and send their acknowledgments before January 31. You don’t want an inbox full of requests for donor acknowledgments from February through April. Of course, if your donors can download tax summaries on demand, you’re less likely to encounter this problem.

What do you need to include in your donation acknowledgment letter?

The primary ways to acknowledge your donations are through email or a letter. There are several details the IRS requires you to include:

- The donor’s name

- Your organization’s full legal name

- A declaration of your organization’s tax-exempt status

- Your organization’s employer identification number (EIN)

- The date the gift was received

- A description of the gift and the amount received

- Any goods or services your organization provided in exchange for the donation

Many nonprofits use a donor management system to automate their acknowledgment letters. Although you could create a system using spreadsheets and mail merge, most donor management platforms or nonprofit CRMs will save you a lot of time by automatically creating a list of the donors you need to acknowledge for their gift.

For example, with Bloomerang, you can automatically trigger emails or mailings to go out when a specific action occurs, like a donor making a gift. Or, if you want to send a special acknowledgment to your major givers or recurring givers, you can set a task to follow up with a call or visit.

There’s also an option for donors to download their year-end tax summaries on demand through their donor account. That way, they’re never stuck waiting for a reply.

How do you format and send your donation acknowledgment letters?

Some nonprofits use the same format for all types of acknowledgments, while others distinguish certain formats for specific donation types or amounts.

For example, if a donor gives a substantial gift, have a senior member of your organization send that donor a handwritten acknowledgment so you can go the extra mile to show how much that donation meant. Alternatively, if a donor signs up for a regular recurring donation, communicate the ongoing story of your nonprofit so the donor feels connected to your work and continues to partner with you.

How to Write Inspiring Gift Acknowledgment Letters

Let’s break down each component of a donation recognition message.

Subject/Preheader

Your donation acknowledgment header or email subject line must briefly allude to the message’s topic. If you’re sending an email acknowledgment, ensure the subject contains words like “Thank you for your donation” or “Donation acknowledgment.” This grabs your donor’s attention and ensures they don’t accidentally overlook or delete your acknowledgment.

Sample subject lines:

- Jemar, thank you for your generous donation to the Sea Turtle Project!

- Sea Turtle Project Donation Acknowledgment

Opening

Once you’ve grabbed your donor’s attention, use the opener to welcome them and thank them for their support.

Body

The body of your acknowledgment letter contains the bulk of your content. This is where you should include the vital IRS information your donor needs for their taxes.

If the donation was a cash contribution, include the date of the gift, the full amount the donor contributed, and the payment method they used (cash, credit card, check, etc.).

If the donation wasn’t a cash contribution, include a description of the non-cash or in-kind gift donation. The IRS does not require you to list the value of the gift.

If goods or services were processed in exchange for the charitable contribution, note these with the fair-market value. According to the IRS, goods or services include tangible and intangible gifts like “cash, property, services, benefits, or privileges.” There are some exceptions, such as insubstantial gifts like t-shirts or stickers. By including this information, you’re providing the donor with the remaining donation amount after accounting for the exchanged goods and services for their tax records.

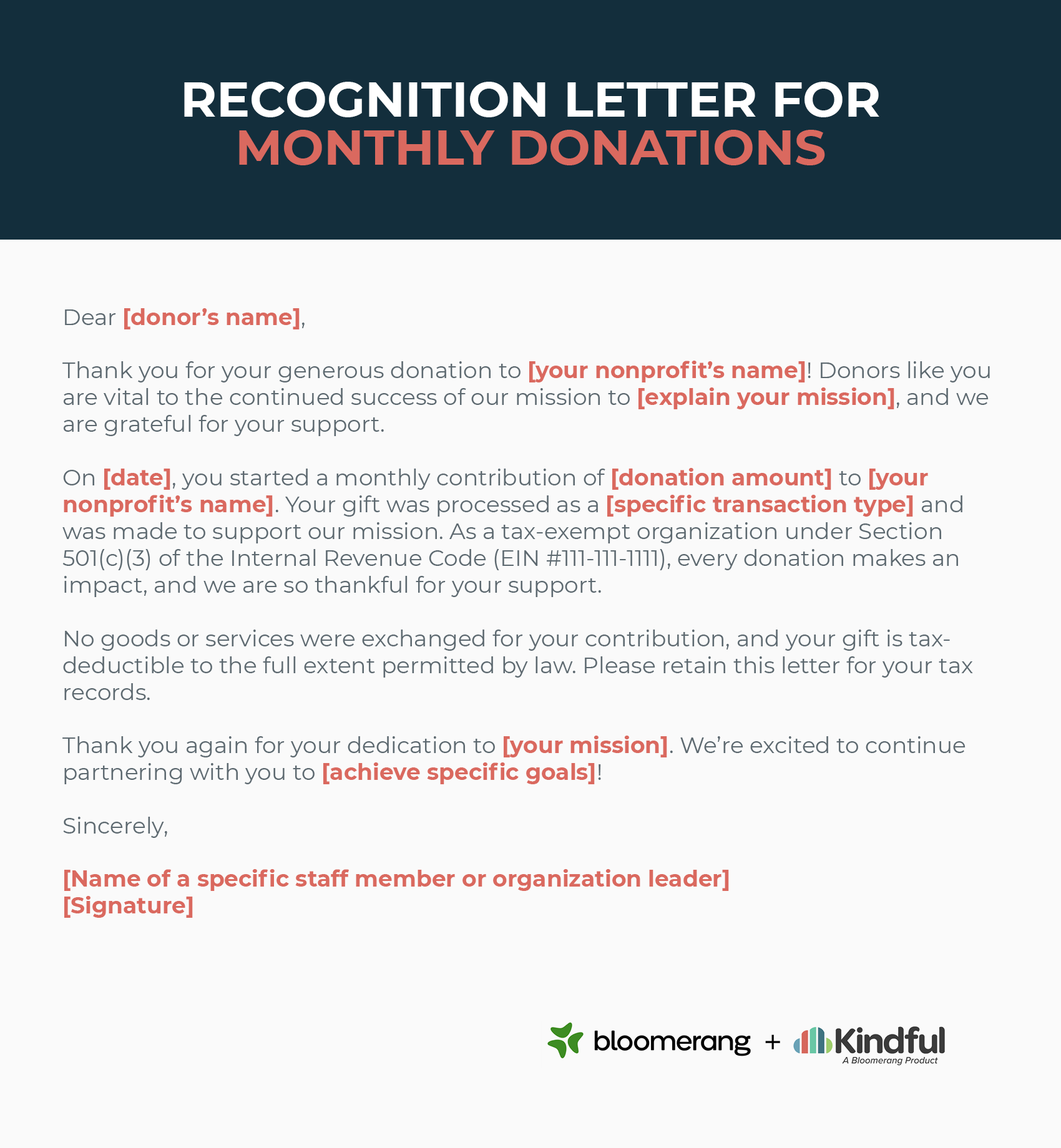

If the donor started a recurring or monthly gift, we recommend sending an immediate donation receipt and quarterly and annual recaps of the donor’s impact.

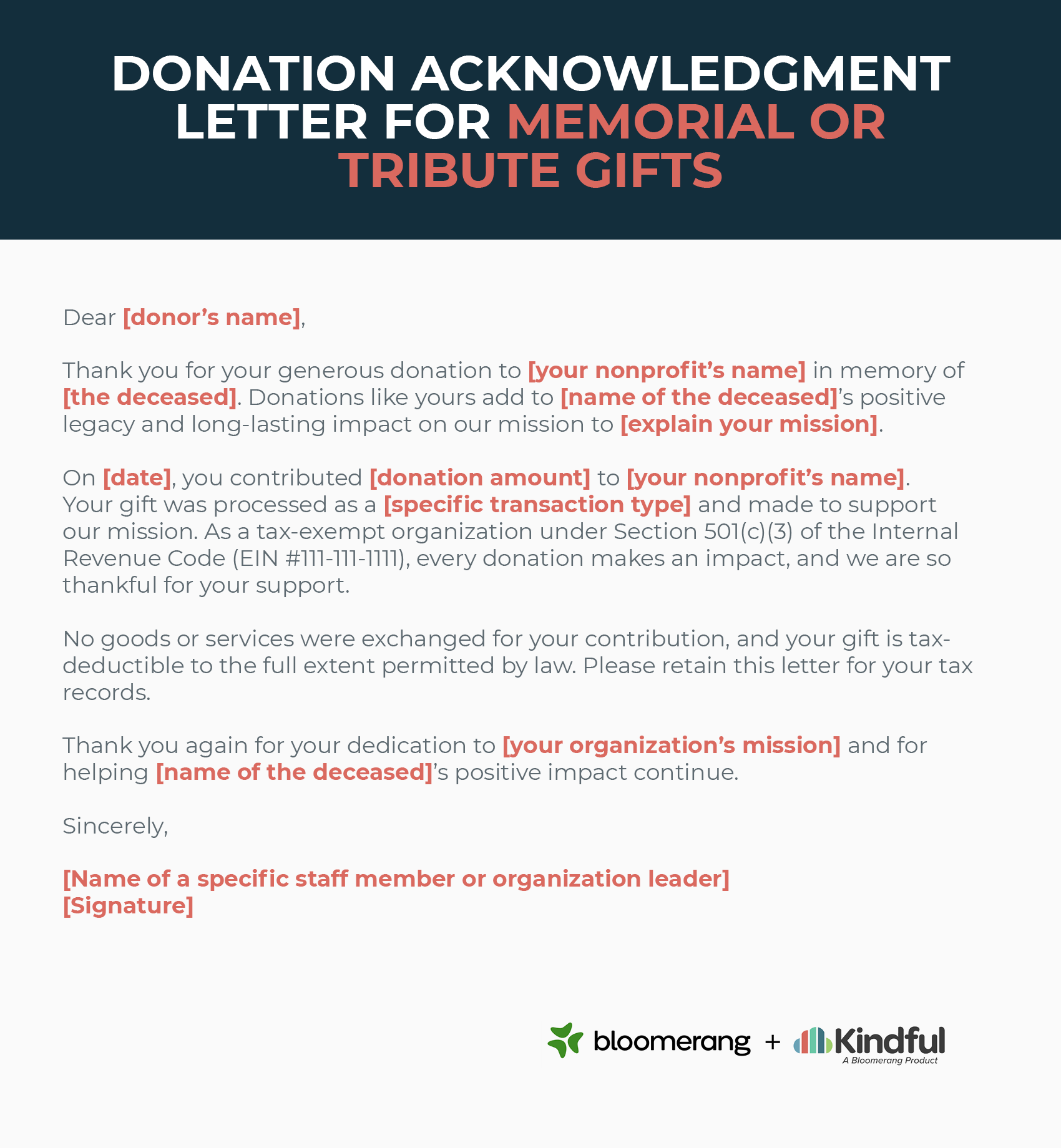

Finally, if a donor gave a tribute or memorial gift, mention the name of the person they gave in memory of, and communicate the long-term impact of tribute donations.

Closing

Now that your donors have all the information they need, use your closing to thank them again, update them on your organization’s progress, or introduce more opportunities to give. The conclusion should act as a friendly sign-off and make your donors feel like part of your team and equal partners in your mission.

This will be your donor’s last impression of your nonprofit until further communication. Make sure to end with empathy so they know you care about their continued support.

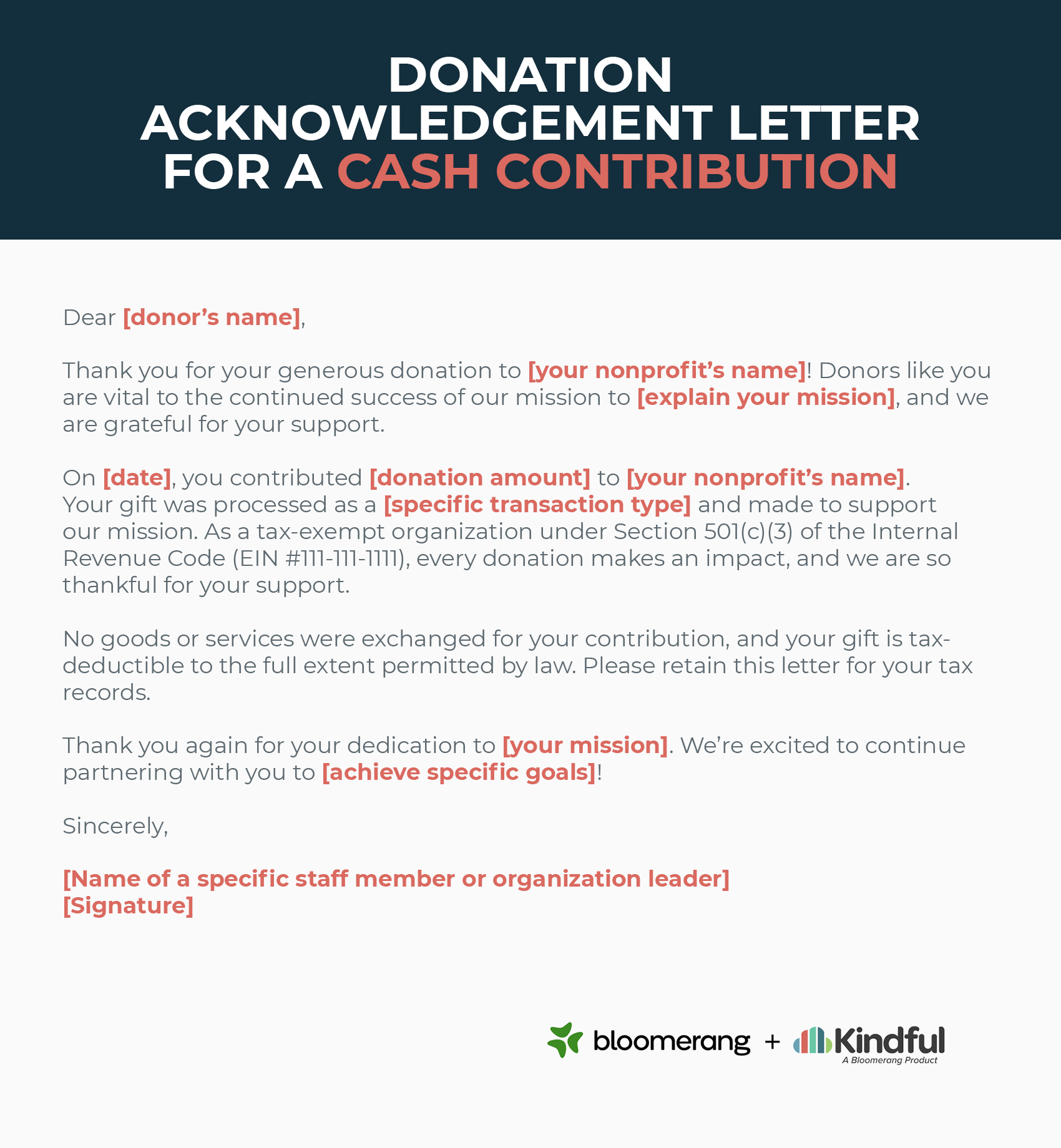

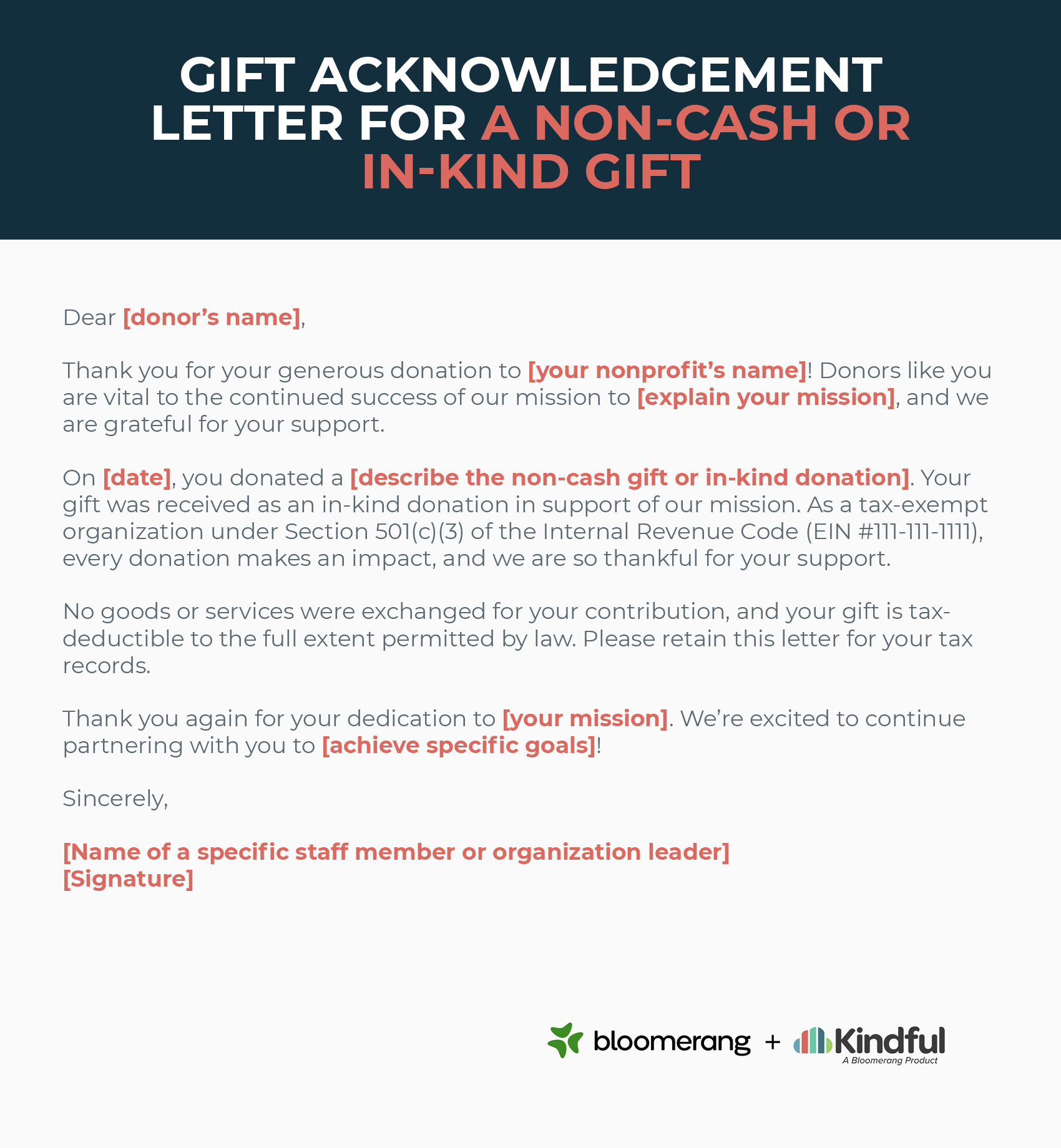

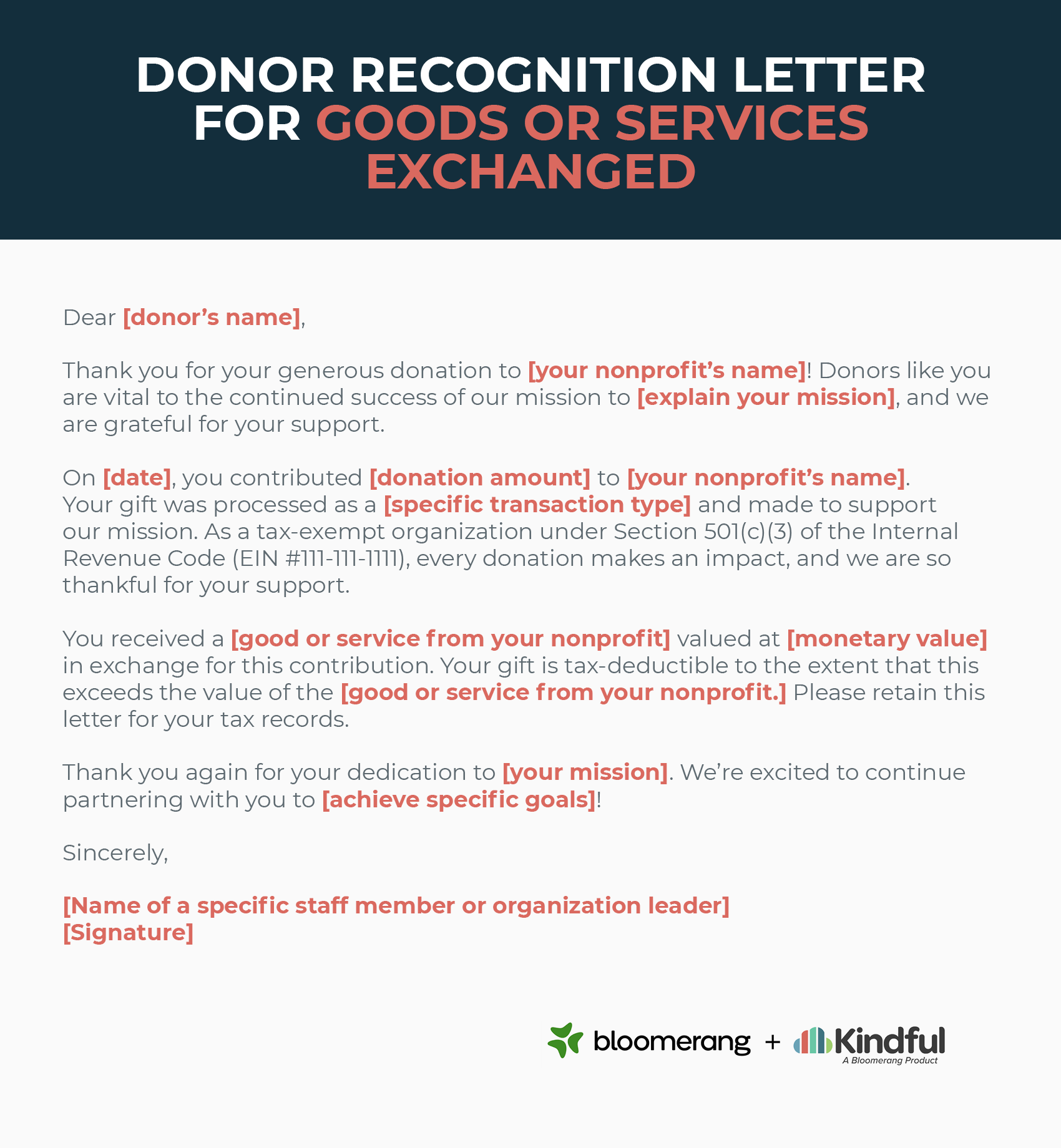

Free Donation Acknowledgment Letter Templates

Use these donation acknowledgment templates as a jumping-off point to build your recognition strategy. Incorporate specific details about your nonprofit to customize the letters and ensure donors feel recognized for their unique contributions.

Donation Acknowledgment Letter for a Cash Contribution

Gift Acknowledgment Letter for a Non-Cash or In-Kind Gift

Donor Recognition Letter for Goods or Services Exchanged

Recognition Letter for Monthly Donations

Donation Acknowledgment Letter for Memorial or Tribute Gifts

Automate Donation Recognition Letters with Your CRM

Using your nonprofit CRM, you can segment similar donors into acknowledgment lists and send automated responses based on particular actions. This speeds up the acknowledgment letter process and ensures you never miss a chance to connect with your donors.

Using your nonprofit CRM to automate your acknowledgments means your nonprofit can connect with donors while continuing to pursue your mission.

Another important reason to automate these acknowledgments is that you don’t want to leave your donors wondering if you received the donation. Send them as soon as possible—ideally within 24 hours of a donation.

Streamlining the Donor Acknowledgment Process with Bloomerang

With Bloomerang’s automated acknowledgment emails and receipts, you can acknowledge contacts based on donation amount, campaign, recurring donations, and more.

Additionally, our products allow you to customize your donation acknowledgment by automatically populating your contact information where you specify. This speeds up the process and ensures every acknowledgment has a personal touch.

By automating your acknowledgments with your nonprofit CRM, you can rest assured that you comply with nonprofit IRS guidelines since you’ve done the work on the front end to keep your donations and contacts synced.

Bloomerang CRM also allows you to:

- Gain strategic oversight into key priority areas like donor retention and campaign performance.

- Segment donors strategically based on criteria like donation frequency, recency, and amount.

- Build more genuine donor relationships with the help of comprehensive donor profiles that detail giving history, communication preferences, and other interactions with your nonprofit.

- Create consistent communication cadences with reminders to follow up with donors, reach out with additional opportunities, and describe the impact of their gifts.

Learn more about Bloomerang here:

Making the most of these features alongside genuine and heartfelt thank-you messages will help you build long-lasting donor relationships.

Wrapping up

An effective donation acknowledgment letter builds the foundation for stronger long-term donor relationships. Using these tips, you can create a template that allows you to thank donors promptly and genuinely while including any information they may need for tax purposes.

For more information on creating effective donor acknowledgment materials, check out these additional resources:

- What Is A Charitable Donation Receipt? Want more information on donation receipts? Learn more about the purpose and structure of donation receipts with this resource from Kindful.

- Donor Appreciation: Creating a Strategy (And 22+ Ideas!). Donation acknowledgment letters are just one aspect of your larger donor appreciation strategy. Use the 22 ideas in this guide for a more robust appreciation approach.

- Donor Stewardship: Key Tips to Build Relationships. Donor appreciation is just one aspect of the larger stewardship approach. This guide will help you build well-rounded donor relationships.