How to start a nonprofit: complete 12-step guide for success

Everyone sees problems in the world, but true visionaries have the drive and passion to engage everyone around them to help solve them. Perhaps you are one of those people who has a unique solution to a problem. If the problem you are trying to solve or the need you are addressing isn’t a quick fix but instead long-range, ongoing, and/or escalating, you might consider forming your own nonprofit. But, keep in mind about 30% of nonprofits fail to exist after 10 years. Because of this, new nonprofit founders must enter the process with a clear plan for success.

Explore key steps and frequently asked questions for starting a nonprofit:

- How to start a nonprofit in 12 steps

- State-specific information for starting a nonprofit

- Starting a nonprofit: FAQs

- 11 questions to ask yourself before starting a nonprofit

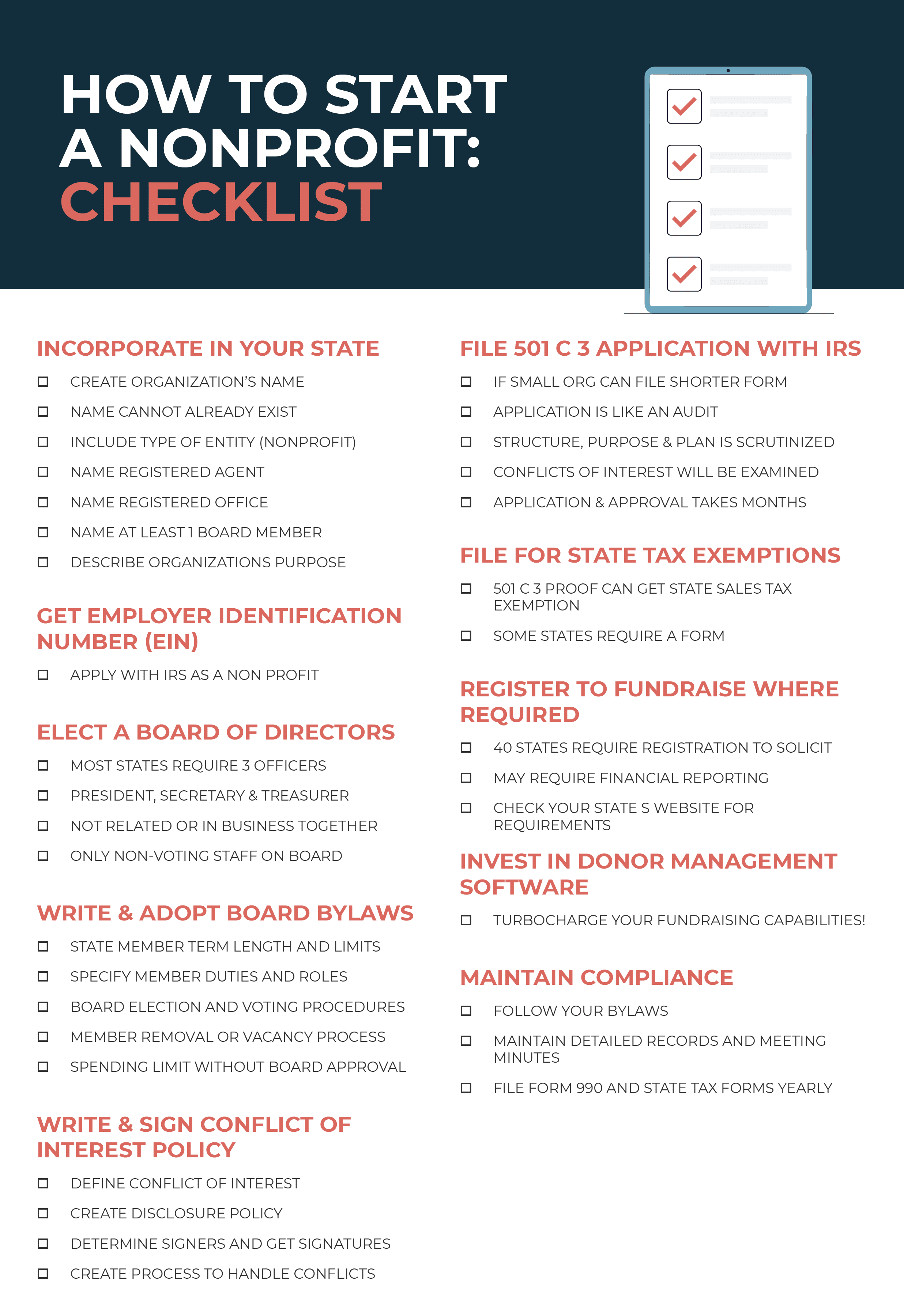

How to start a nonprofit in 12 easy steps

1. Compile a needs assessment

Before anything else, determine if there’s a real, tangible need for your nonprofit. Talk to community members, stakeholders, and other organizations to understand the challenges they face. Also, gather data from surveys, interviews, focus groups, or existing reports to back up your findings with evidence. Additionally, check out other organizations to see whether the issue you want to address is already being tackled. If it is, consider how your nonprofit could complement their efforts or fill gaps they might’ve missed.

A robust needs assessment will provide focus for your mission and make it easier to articulate your goals when seeking support from stakeholders, funders, or donors. It serves as a foundation for creating effective programs and measuring your impact.

2. Research federal and state legal requirements

Every country and state has unique requirements for nonprofit registration, so it’s essential to familiarize yourself with the legal landscape early on. For organizations in the U.S., the first step is understanding the IRS regulations for achieving 501(c)(3) tax-exempt status, which allows your nonprofit to operate as a tax-exempt organization and provides benefits like tax-deductible donations for your supporters. This process involves filing IRS Form 1023, along with paying the associated fees.

Additionally, you’ll want to check your state’s specific guidelines for nonprofit registration, as rules and regulations can vary widely. Many states require nonprofits to register as charitable organizations or comply with ongoing reporting requirements, such as annual filings or audits. Being thorough at this stage will save you time and potential legal headaches down the road.

3. Incorporate your nonprofit

Filing your articles of incorporation allows you to be recognized as a business entity in your state. It does not give you nonprofit status, however. It serves to remove you, the founder, from being personally liable. The requirements and cost of incorporating vary from state to state. You should be able to find information on how to file your articles of incorporation on your secretary of state’s website. Following the directions at the site, you may be able to submit your application online.

4. Secure an Employer Identification Number (EIN)

Every organization must have an employer identification number (EIN), even if it will not have employees. The EIN is a unique number that identifies the organization to the Internal Revenue Service. You can apply for an EIN online, by mail, or by fax.

5. Elect a board of directors

You cannot submit your 501(c)(3) application to the IRS for your nonprofit status without listing your board officers with name, title, and contact information. Most states require a minimum of three individuals on the board: a President, Secretary, and Treasurer. Ideally, these individuals are not blood-related or in business together. Public charities must have a board with a majority of unrelated members. Paid staff members are not allowed to be on the board unless they recuse themselves from voting.

6. Create your bylaws

Your 501(c)(3) application to the IRS must include bylaws. Bylaws are the main governing document of your nonprofit and will act as a guide and decision-making tool for the board of directors.

Bylaws specify board rules and practices. Examples of bylaws include:

- Board member term length and limits, i.e. terms last one year. and members can’t serve more than two consecutive terms

- Board member duties and roles, i.e. the Chair of the board presides over the meetings and has the power to call them, and the Chair-Elect shall have all powers and duties of the Chair during the Chair’s absence, disability, or disqualification, or during any vacancy in the position of Chair

- Board election and voting procedures, such as the process for electing new members and how many board members must be present to have a quorum

- If a non-voting staff member like an Executive Director is allowed to serve on the board

- Expectations around meeting attendance and an allowance of a limited number of consecutive absences before their term is considered vacant

- Process of removal of board members by a majority vote

- Process for handling unexpected board vacancies

- Limits on financial purchases (i.e. $10,000 or more) by the Executive Director without board approval or a co-signature by the Treasurer

Bylaws serve as a safeguard and supplement those already required by the state and IRS.

Here are some tips to develop your bylaws from Bloomerang’s free template:

- State your organization’s name and purpose

- Establish guidelines for your board’s purpose, powers, tenure, size, election processes, vacancies, resignations, and removal process

- Create a structure for electing board officers

- Establish policies for board meetings, such as the frequency and meeting format

- Define your fiscal year

- Create policies for developing committees. Two committee types include: 1) standing committees like governance, development, finance, and executive committees and 2) ad hoc committees.

7. Develop a conflict of interest policy

After you create your bylaws, develop a written conflict of interest policy. Check if your state of incorporation has specific requirements for what must be included in the policy. A strong conflict of interest policy will help ensure your organization is well governed and protect your leadership.

A conflict of interest policy requires those with a real or perceived conflict to disclose it. Also, it prohibits interested board members from voting on any matter where there could be conflict.

Elements typically included in a conflict of interest policy include:

- A definition of what constitutes a conflict of interest: typically a scenario where an individual’s personal or financial situation could compromise their objectivity in decision-making.

- A policy for disclosing conflicts of interest

- Information about who the policy applies to, including board members, staff, leaders, etc.

- Uniform procedures for handling conflicts of interest, such as asking the person involved to recuse themselves from certain decisions

Review and approve all of these documents at your first board meeting. In addition, use the time to elect officers and establish roles. Remember, your nonprofit’s first meeting is an opportunity to set the tone for your organization and create a shared vision for its future, so keep this meeting as focused and productive as possible. Your board secretary should maintain official notes of all board meetings and pertinent committee meetings, like the Finance Committee, Governance Committee, and Executive Committee.

8. Apply for federal tax-exempt status

Once you have completed steps 1-5, you are ready to apply for 501(c)(3) tax-exempt status.

The most common type of nonprofit organization is the 501(c)(3), which covers all charitable, religious, scientific, and literary organizations. You can see the full list of the 29 different types of charity organizations here.

If you are a small organization with gross income under $50,000 for the last 3 years and expect to have gross income under $50,000 for the next 3 years, you can file a shorter Form 1023-EZ, which can be approved in as little as 4 weeks.

You should think of your application as an audit of proposed (and/or previous) activity and a thorough examination of your nonprofit’s governing structure, purpose, and planned programs. The IRS wants to make sure the organization is formed exclusively for 501(c)(3) purposes and that its programs are designed to fulfill these stated purposes. They are closely monitoring any conflicts of interest and/or benefits to insiders. Both of those scenarios are grounds for denial.

With the required attachments, schedules, and other materials that may be necessary, it is not uncommon for these submissions to the IRS to be up to 100 pages.

9. File for state tax exemptions

If you received your 501(c) (3) designation from the IRS, you can use that designation to avoid paying sales tax if your organization operates in a state with sales tax. In some states, merely showing your IRS determination letter or your tax-id number is enough, whereas in others, you may be required to complete a form. For most nonprofits, it might only make sense to apply for sales tax exemption in your home state or in nearby states where you conduct a lot of business. However, larger nonprofits conducting business and making purchases in multiple states may pursue sales-tax exemptions in multiple states.

10. Register to fundraise where required

Currently, 40 states require nonprofits to register with their state before soliciting contributions from residents. In addition, these charities may be required to file periodic financial reports. Visit your state website to find information on your state registration requirements.

11. Invest in donor management software

After you’ve satisfied all of your legal requirements and started fundraising, we recommend investing in donor management software. Donor management software will help you keep all your donor information organized in one centralized location. Top software solutions like Bloomerang offer features such as:

- Donor profiles to store crucial donor information such as their full names and contact information

- Constituent timelines to track all interactions your nonprofit has had with donors

- Marketing and engagement tools that allow you to create personalized donor outreach using segmentation

- Reporting and analytics features you can use to run reports and track donor behaviors and trends over time

- Wealth screening tools that automatically scan your database to identify potential major donors

- Fundraising and event management tools for an all-in-one platform for nonprofits

- Integrations with other top nonprofit software platforms so you can seamlessly transfer data between all of your solutions

The goal of this software is to help you centralize all of your data into one place. In other words, you can track your nonprofit’s financial success, manage donor relationships, and more easily access the different marketing, fundraising, and event registration tools you’re using.

Plus, donor management software sets your nonprofit up for long-term growth. These solutions can scale up as your nonprofit grows, allowing you to add contacts to your system and maintain accurate records on all supporters.

12. Maintain compliance

Your 501(c)(3) status, once granted, never needs to be renewed. However, you need to fulfill the following to maintain your status:

- Follow your by-laws

- Maintain detailed financial records and minutes of all board meetings

- File your 990 each year with the IRS. You can think of a 990 as an informational tax form. It is a publicly available document that details your organization’s activities, finances, board members, and lead staff (and compensation).

- File state tax forms annually

Most states require nonprofits to file paperwork to fundraise in their state. States that do not require this paperwork may require you to file for corporate tax exemption.

Getting your 501(c)(3) status approved is a bit like taking home a new baby, puppy or getting the keys to your first home. There’s a ton of excitement but it’s also where the real work begins. The Bloomerang is here to support you at every stage!

Disclaimer

Because state laws vary and laws can always change, we encourage you to seek out local expertise (either an attorney, accountant or someone familiar with the laws affecting how charitable organizations operate in your state) to ensure your new nonprofit complies with state, local and federal law.

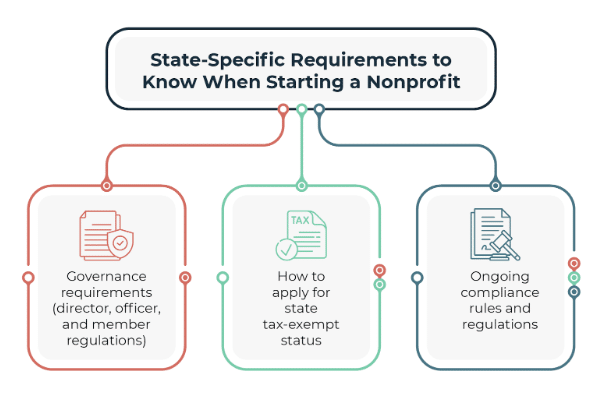

State-specific information for starting a nonprofit

Once you’re confident with the general process for starting a nonprofit, it’s time to look at some of the specifics that can vary by state. Here’s a few specific guidelines to keep in mind when incorporating nonprofits in the four most popular states for charitable organizations: California, Texas, New York, and Florida.

How to start a nonprofit in California

California, with the largest population, is naturally one of the most popular states for charitable organizations, which also means it has some extra requirements for those organizations.

These unique requirements include:

- Directors: A minimum of one director is required

- Officers required: Chair of the board, secretary, treasurer or chief financial officer or both, all elected by the board

- Members: Members are optional; quorum is 1/3 of the votes

- Tax-exempt status: You must file for tax-exempt status with the state of California and the IRS. You have two options for state filing:

- Exemption Application (Form 3500)

- Submission of Exemption Request (Form 3500A)

- Ongoing compliance: California nonprofits must comply with the Nonprofit Integrity Act – specifications include financial auditing requirements and fundraising oversight.

How to start a nonprofit in Texas

Everything’s bigger in Texas, including the nonprofit world.

With so many charitable organizations, here are some extra requirements from Texas to start a nonprofit:

- Directors: Minimum of three required, terms last until a successor is elected, appointed, or designated and qualified. A majority is required for quorum and a management committee must have two people and the majority of directors (with some exceptions).

- Officers required: President and secretary

- Members: Optional, regular meetings are required annually, and quorum is 1/10th of the votes.

- Tax-exempt status: Complete AP-205, Application for Exemption – Charitable Organizations, must apply with the Texas Comptroller of Public Accounts.

- Ongoing compliance: Nonprofits must file yearly corporate reports to remain in good standing with the state.

How to start a nonprofit in New York

The Big Apple has the third most nonprofits of any state in the U.S.!

If you’re starting a nonprofit in New York, check out these special requirements:

- Directors: A minimum of three is required. They must be 18 years of age (with some exceptions, though). They serve one-year terms, unless specified otherwise in the bylaws, for a maximum of five years. A majority is required for a quorum, and committees must have at least three directors.

- Officers required: A president, one or more vice presidents, a secretary, and a treasurer

- Members: Members are optional, regular annual meetings are required, and a quorum requires 1/10th of the votes.

- Tax-exempt status: File Form ST-119.2, Application for an Exempt Organization Certificate

- Ongoing compliance: Charities operating in New York must register and file annual financial reports with the State Attorney General’s office.

How to start a nonprofit in Florida

The Sunshine State has over 100,000 charitable organizations!

Keep these unique requirements in mind when starting a nonprofit in Florida:

- Directors: A minimum of three directors is required. They must be over 18 years old unless permitted by the board of directors or bylaws (if so, one director may be 15 years of age or older). They serve one-year terms. A majority is required for a quorum, and every committee must have a minimum of two directors.

- Officers required: Must be defined in the bylaws or articles of incorporation. Must have one officer to prepare meeting minutes and authenticate records. The board elects officers who serve one term.

- Members: Optional; quorum should be defined in the bylaws or articles.

- Tax-exempt status: File a completed Application for a Consumer’s Certificate of Exemption (Form DR-5) with the Florida Department of Revenue.

- Ongoing compliance: Any organization that solicits donations in Florida must file an annual report with the Florida Department of State.

Starting a nonprofit: FAQs

What is a nonprofit?

A nonprofit is a type of charitable organization created to improve society in some way. Nonprofits are legally defined by the IRS as “Organizations organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, educational, or other specified purposes and that meet certain other requirements are tax-exempt under Internal Revenue Code Section 501(c)(3).”

What types of nonprofits are there?

Some common nonprofit types include charities, foundations, advocacy groups, and professional associations. From the arts to healthcare to the environment, there are nonprofits for many different sectors and causes. If you’re unsure about what category your organization falls under, check out this list.

Why start a nonprofit (and not a for-profit)?

To receive and maintain tax-exempt status, the majority of a nonprofit’s income must come through public donations from individuals, corporations, and/or grants. Nonprofit organizations exist to serve the public, not to benefit the private interests of a single person, whether staff or board members.

Nonprofits offer free or low-cost programs and services to the public and rely on donations to do so. However, if your main goal is to make money and you have a successful revenue model, you would be wise to consider starting a for-profit.

How can I tell if my nonprofit will succeed?

All businesses need four things to survive: a brilliant idea, a great business plan, top-notch leadership and money.

For a nonprofit, initial success is determined by how exactly how brilliant the idea (also known as the “mission”) is.

Here’s how to test your idea out and gain initial feedback:

- Go to any networking event to test your idea with professionals you don’t know (no polling friends, family or co-workers!)

- When people ask you what you do, tell them you are the Executive Director of an organization that [insert your mission here.]

- How do they respond?

Good signs

If you get any responses like the ones below, you’re on the right track:

- “I wish that had been around when I was a kid!”

- “Wow, can I get involved or volunteer?”

- “That is so needed, thank you for doing that!”

- “I think I can introduce you to people who can help you.”

Bad signs

Go back to the drawing board if people reply by asking:

- “Doesn’t [insert competitor name here] already do that?”

- “Why is that needed?”

- “Wait, I don’t understand, can you repeat what you do?”

Can I start a nonprofit from nothing?

Sure! Most nonprofits begin from very humble origins.

The most important qualities to bring to the table are a clear mission and vision, passion for your cause and the dedication needed to bring your vision to life.

The tips in this guide will help you get your organization up and running, even if you’re starting from nothing.

What does it cost to start a nonprofit organization?

While you can start a nonprofit for nothing, there are costs involved with starting up a charitable organization you factor into your plans.

Costs depend on:

- State filing fees

- IRS costs

- Charitable solicitation registration fees

- Legal expenses

- Operational and overhead costs

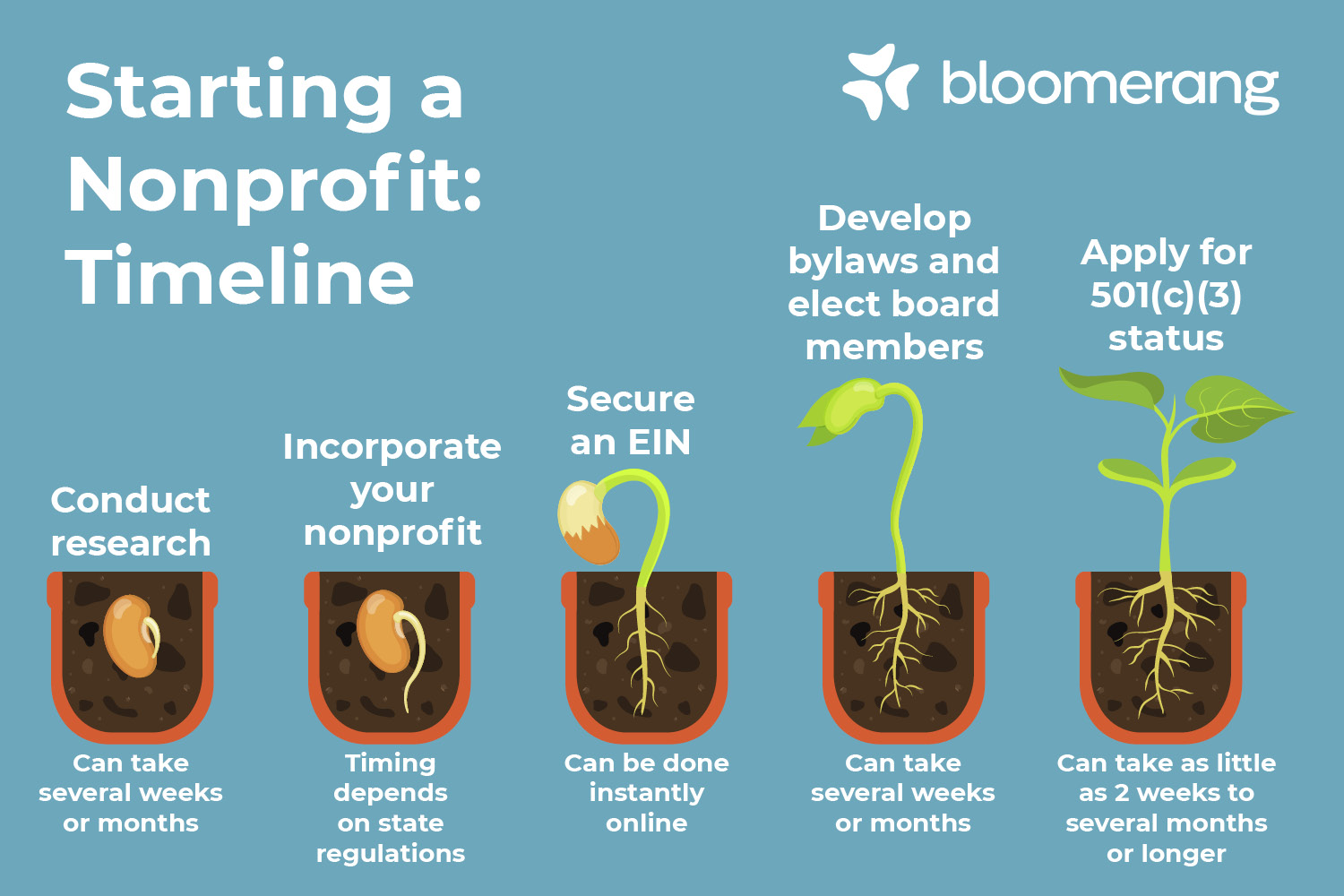

How quickly can I start a nonprofit with no money?

Starting a nonprofit doesn’t happen overnight, and you will need some funds to submit your paperwork, however, it’s probably easier and less expensive than you think.

The timeline generally looks like this:

- Conduct initial research: Study similar nonprofits, their programs, successes or failures, funding, and how you are similar or different. Are people excited when they hear about your cause? Do you have the financial resources to fund it? If not, how will you get the funds? Who will be on your board? Do you have the time and energy to run it? Do you have enough board members and volunteers to do the work? Is your idea an unmet need? Who is your competition, and how are you different from them?

- Incorporate your nonprofit in your state: The timing for this step depends on your state’s regulations; it can take a few days or several weeks.

- Secure an Employer Identification Number (EIN): This can be done instantly online.

- Develop your bylaws and elect a board of directors: This can take several weeks or months.

- Apply for 501(c)(3) status through the IRS: Depending on the complexity of your nonprofit, this step can take as little as 2 weeks or as long as several months or even a year. Your costs could be anywhere from $275 to $2,500, not including legal fees. Applying is not a guarantee of tax exemption, as applications can be denied.

Is there any way to get an “umbrella” fiscal sponsor to give me tax-exempt status?

Yes! Many community foundations are willing to give umbrella nonprofit status to nonprofits who may be just starting out. Additionally, individuals seeking tax-exempt status for a short-term charitable project with no need to formalize as their own nonprofit organization may seek out an existing nonprofit with a complimentary mission to be the project’s fiscal sponsor.

Can a nonprofit founder receive a salary?

Yes, you can receive a salary for your nonprofit work. However, the IRS dictates that your salary must be “reasonable” for the type of work you’re doing — “the value that would ordinarily be paid for like services by like enterprises under like circumstances.”

11 questions to ask yourself before starting a nonprofit

- Have you identified a clear need in your community that isn’t being addressed by other organizations?

- How will you distinguish your nonprofit from similar organizations?

- Can you think of a group of people who could be involved in running your nonprofit? Board members, volunteers, potential staff members, etc.

- Where will you seek initial funding?

- Do you have the time and dedication to get the organization up and running?

- Do people in your community seem willing to support your new nonprofit?

- How will you measure success for your nonprofit?

- What potential external threats and challenges could your organization face?

- How will you manage setbacks or obstacles while starting your organization?

- Are there other organizations, such as businesses or foundations, that you can potentially partner with in your community?

- Is your nonprofit idea scalable? Can you grow your nonprofit sustainably over time?

Final thoughts

Now that you are officially a nonprofit and have purchased your fundraising and donor management solution, it’s time to fundraise!

At Bloomerang, we’ve crafted a treasure trove of fundraising resources for you, including fundraising guides and templates, webinars, how-to articles, and even an expert on standby to answer your questions.

Getting your 501(c)(3) status approved is like taking home a new baby or puppy or getting the keys to your first home. There’s a ton of excitement, but it’s also where the real work begins. Remember, the Bloomerang team is here to support you at every stage!

Schedule a live demo with Bloomerang, and we’ll show you how easy it is to create and automate reports, utilize online and offline fundraising tools, quickly integrate and access all your data, and ultimately create more time to engage your donors.