Accounting for Nonprofits

Most people working at nonprofit organizations aren’t accounting professionals. Rather, they’re passionate individuals who work hard to make their community and the world a better place.

However, accounting is a key element to changing the world through a nonprofit organization. Nonprofit organizations need effective and accurate accounting principles in order to make the best use of their limited resources and fulfill their mission.

Imagine a nonprofit organization that has a mission with all of the right intentions but doesn’t manage their finances well. Improper planning and ineffective funding would likely cause their programming to collapse. Meanwhile, organizations with impactful and effective accounting will be more likely to allocate their resources appropriately and drive their mission forward.

While you may not have entered the nonprofit sector to become a financial expert, nonprofit accounting is vital to the success of your organization.

What is nonprofit accounting?

Nonprofit accounting is the way a nonprofit’s financial transactions are planned for, recorded, and reported over time. Accounting for nonprofits also differs from that in the for-profit sector in a number of other ways. For instance, nonprofits have no legal ownership interests and they earn their funding from supporters who do not expect a financial return on their investment.

Because nonprofits are so unique, they leverage a different type of accounting, also known as “fund accounting” to manage their finances.

The primary difference between fund accounting and standard accounting is that while standard accounting uses one primary fund for all expenses, fund accounting separates money into various dedicated “funds” according to their intended purpose. For example, if a donor restricts their donation to ensure it’s only used to fund that organization’s scholarship fund, that money would be added to a restricted fund set aside for the scholarship. If a donor does not restrict the donations they provide, that money can be added to your organization’s annual fund and used for overhead, programs, or any other expenses.

While you’ll need to keep track of details regarding restrictions and other information about specific donations in your accounting system, don’t get this mixed up with the information you keep in your donor database. Donor data is useful for building relationships, but it can clog up your accounting system. Separate financial information from donor information to keep your data organized.

There are other differences between for- and nonprofit accounting. For example, instead of measuring equity, nonprofits record their net assets in a balance sheet. They also don’t have investors, making equity irrelevant.

Nonprofit and for-profit accounting are very different entities and require different approaches. Therefore, they also require different technology and a unique set of skills from your accountant.

Nonprofit accounting vs. bookkeeping

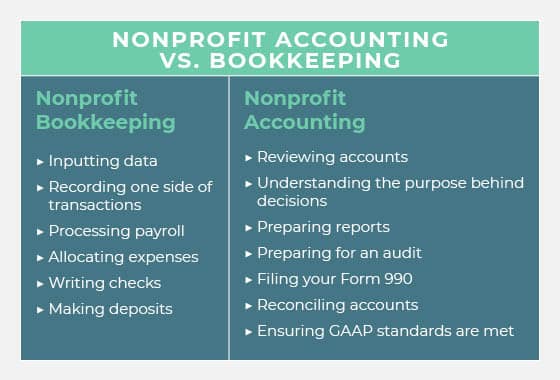

We’ve covered briefly the differences between nonprofit and for-profit accounting practices. However, there is another distinction we need to cover when discussing accounting at nonprofit organizations and that is the difference between accounting and bookkeeping.

Often, they’re lumped together in conversation and even in practice. However, they are very different concepts, and understanding the difference will help you allocate tasks across your team.

Here are the key differences between these two terms:

Nonprofit bookkeeping is the upkeep of everyday financial activities at your nonprofit. Some of the activities that your nonprofit’s bookkeeper completes include:

- Inputting data

- Recording one side of transactions

- Processing payroll

- Allocating expenses

- Writing checks

- Making deposits

Meanwhile, nonprofit accounting is the process of compiling reports and analyzing key information to inform strategic decisions. Some of the activities that your nonprofit accountant completes include:

- Reviewing accounts

- Understanding the purpose behind decisions

- Preparing reports

- Preparing for an audit

- Filing your Form 990

- Reconciling accounts

- Ensuring GAAP standards are met

As you can see, the role of the nonprofit bookkeeper versus the accountant differ significantly, meaning you’ll need to consider these diverging responsibilities and their corresponding qualifications when hiring accountants and bookkeepers.

Bookkeepers don’t generally require specialized education for their positions, though it doesn’t hurt if a candidate has them. Meanwhile, accountants generally require at least a four-year degree. Some may also have a Certified Personal Accounting (CPA) license.

Both of these positions are vital to your organization’s success, but they shouldn’t be lumped together. While a volunteer or staff member might be able to take on their organization’s bookkeeping duties, they’d be hard-pressed to take on an accountant’s responsibilities.

Key nonprofit accounting documents

Nonprofit accounting, similar to other aspects of your nonprofit’s strategy, requires your organization to compile several key reports and documents to organize your financial data.

Therefore, nonprofit accountants have the vital responsibility of preparing, analyzing, and using various financial documents to explain the financial health and position of the organization. This helps determine the next best steps for maintaining an effective and fiscally sound organization.

Some of these documents include the following:

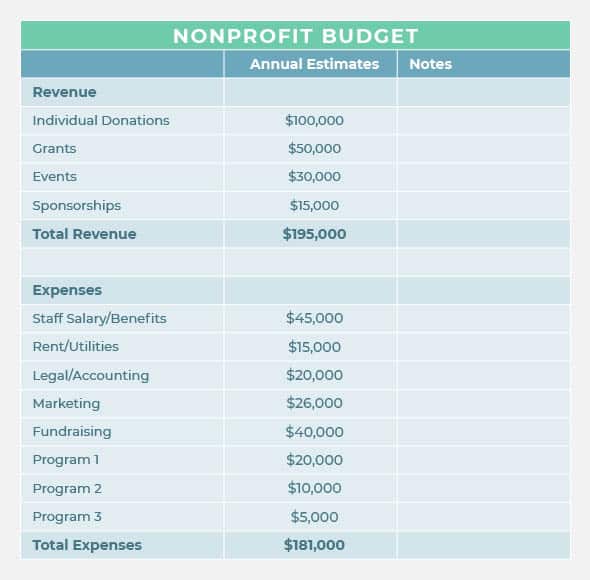

Nonprofit budget

Your nonprofit’s budget is your guiding financial document, allowing you to plan out your expenses and projected revenue for the year. This is not a document that you’ll only visit once each year, but one that you’ll review over and over again, continuously course-correcting according to your organization’s most prevalent needs.

To make sure this document is as effective as possible, your organization should be sure to:

- Define the specific activities on which you’ll be spending nonprofit funds.

- Set timeframes for when you anticipate earning revenue and incurring expenses.

- Choose realistic metrics and goals for your budgetary plans.

When you’ve set your budget, it will look something like this:

While you’ll have one annual budget that you rely on for your organization’s overarching activities, you’ll also likely have other budgets throughout the year as well. Set short-term budgets for your events and campaigns. Then, return to your annual budget and make updates according to your actual expenses and revenue results from these shorter initiatives.

Statement of financial position

For-profit companies use balance sheets to show the assets of their organization that can then be distributed to stockholders as retained earnings. However, nonprofits don’t have stockholders, so they have no need for a balance sheet.

Instead, nonprofits leverage a statement of financial position. This document is designed to show your nonprofit’s assets. Instead of identifying these assets with the intention of distributing them to stockholders, they are intended to be reinvested into the nonprofit.

The simplest equation to represent the statement of financial position is:

Net Assets = Assets – Liabilities

The document usually ends up with a few more details than that simple equation. It will likely end up looking something more like this:

Your nonprofit’s statement of financial position is a great indicator of your organization’s overall financial health. If you don’t have enough funding to reinvest into the organization (the net assets available to your team), it will be challenging to achieve growth.

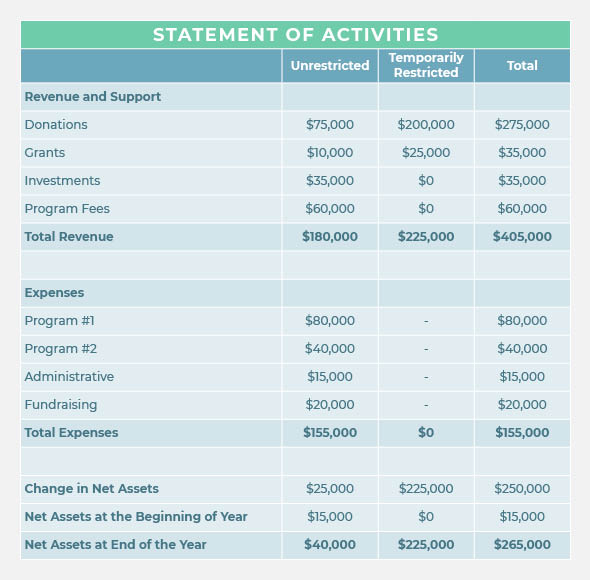

Statement of activities

For-profit companies leverage an income statement to show how much they have earned or lost over a specific period of time. By contrast, nonprofits are less focused on income and more worried about the activities they’ve been able to carry out for their mission. That’s why they use a statement of activities instead of an income statement.

In nonprofit accounting, the statement of activities represents an organization’s bottom line, reporting on the changes in net assets of the nonprofit and characterizing the revenue and expenses accordingly.

Your completed statement of activities should end up looking something like this:

Essentially, this statement will organize and categorize your expenses and revenue sources. This report also allows your organization to analyze the changes in your net assets throughout the year.

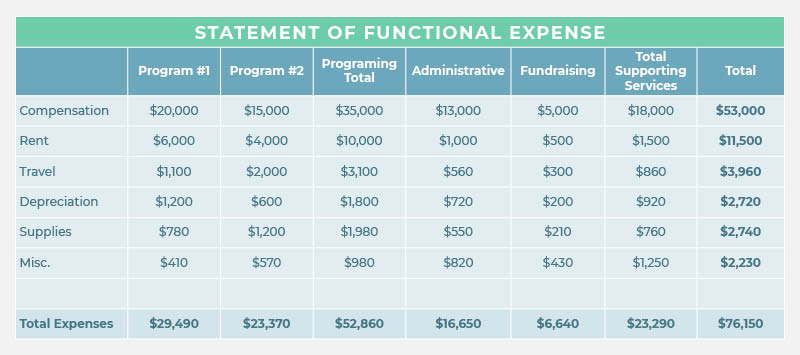

Statement of functional expenses

Your statement of functional expenses enables you to allocate your expenses according to their use at your organization. Essentially, it classifies your expenses according to your use of your organization’s funds.

When you build out your statement of functional expenses, you might spell out as few as three functional expenses or as many as forty. Either way, this sheer number is not indicative of your organization’s financial health, but the breadth of your financial reporting. Most organizations have three primary functional expenses:

- Administrative

- Fundraising

- Programming

However, these categories may be further broken down for a more detailed version of this statement. This means your form will likely end up looking something like this:

The statement of functional expense is especially helpful when it comes time to file your nonprofit’s annual Form 990, which we’ll cover later on. Because expenses have to be separated into the three categories above on your tax forms, this report makes it easy to find specific allocation information.

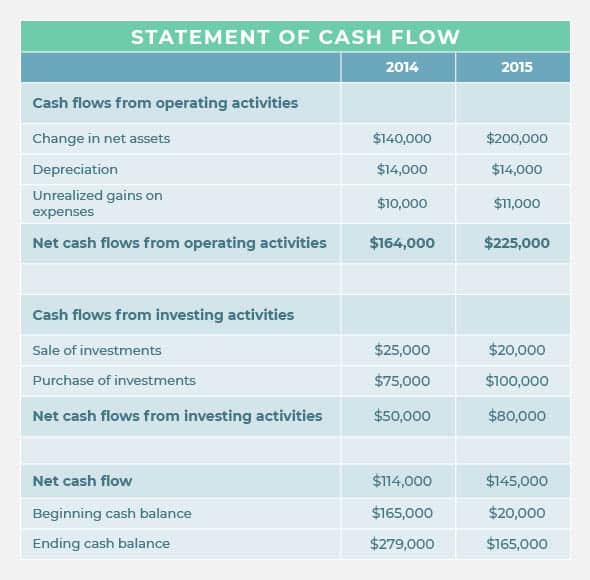

Statement of cash flow

Nonprofits and for-profits alike need to understand their cash flow and provide a statement about how it moves in and out of the organization. Generally, these reports are pulled once per month, reflecting the previous thirteen months. Using this report, nonprofits can determine the trends that are impacting the revenue and expenses incurred at their organization.

When you complete your statement of cash flow, it will look something like the following:

Understanding the flow of cash in and out of your nonprofit will help you and your accounting team plan and budget for regularly occurring financial trends. For example, if you recognize that you generally have less revenue generated during the summer months (a common trend among nonprofits), then you might save some funding from the winter to be spent during this timeframe.

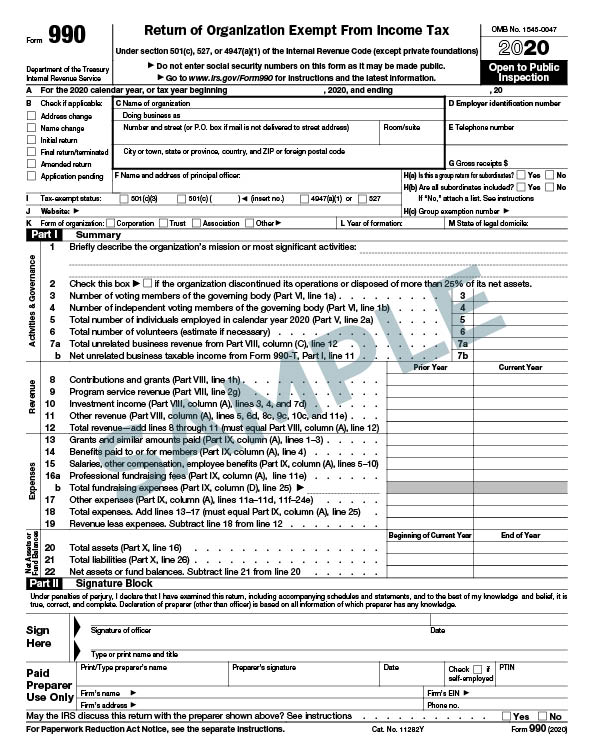

Form 990

Your IRS Form 990 is the annual tax form that your nonprofit accounting team submits to maintain your tax-exempt status with the federal government. Some states also require a copy of your Form 990 for your organization to maintain compliance with state charitable registration requirements.

Your Form 990 is a publicly available document that describes your nonprofit’s annual financial position and how you’ve allocated functional expenses (similar to your statement of functional expense).

Below is an example of what this form might look like:

This tax form is not only necessary for your nonprofit to stay compliant with federal and some states’ regulations, but it can also be key for your fundraising efforts. It increases transparency among your organization and supporters. Some prospective donors will search for your Form 990 to be sure your nonprofit is effectively using your funding before they make a contribution.

Nonprofit accounting best practices

You’ll want to ensure your accounting practices are as effective and efficient as possible, whether your executive members are taking on the responsibility, you outsource the responsibility, or you hire someone to handle accounting in-house. Here are the best practices we recommend implementing at any organization:

- Leverage nonprofit-specific accounting software. Because nonprofit accounting differs from for-profit accounting, you should ensure the software you have on hand will handle the tasks unique to your accounting system. Don’t shoehorn your processes into an imperfect for-profit accounting system. Investing in a nonprofit-specific software solution will ensure you have the tools you need to accomplish your accounting goals.

- Revisit your organization’s budget often. Setting and revisiting your nonprofit budget shouldn’t be a one-time task on your to-do list. Instead, it’s a document that you should revisit on a regular basis, making adjustments when your actual revenue and expenses stray from your original plan.

- Plan overhead expenses carefully. Traditional thinking advises limiting overhead as much as possible to increase the ROI of your fundraising efforts. However, sometimes increasing overhead is necessary to promote growth at your nonprofit. Review your overhead expenses carefully to be sure you’re treading the fine line between investing in your own growth without overspending on unnecessary items.

- Support your multi-year strategic plan. Great nonprofits check in on their budgets and pull reports every month and quarter to make sure their finances are in check. To take it one step further, leverage your nonprofit accounting system to support your multi-year plans. Review your goals and any multi-year fundraising campaigns or projects on a regular basis to be sure your current financial strategies are geared toward achieving those goals.

Implementing best practices and holding yourself accountable for effective nonprofit accounting can result in a positive trickle-down effect on the rest of your nonprofit, impacting your management, fundraising, and organizational strategies as well.

When you have accurate numbers for the cost and projected revenue of fundraising campaigns, you can end your campaign in the black and amplify programming. By understanding how well you have kept to your original budget, you can make adjustments that lead your programming through the entire year, increasing your impact.

Nonprofit accounting platforms

Jitasa

Jitasa is an outsourced accounting service specifically designed to help nonprofits with their bookkeeping and accounting processes. They leverage QuickBooks to organize finances for organizations.

They’re not the only option though! You can check out Bloomerang’s accounting consulting recommendations to find other accounting firms that can help you build out your nonprofit’s financial management strategies.

Quickbooks For Nonprofits

QuickBooks is known and loved by many specifically for its polished, no-fuss desktop and user-friendly interface. It has an impressive suite of core features including billing and invoicing, collections, cash management, fixed asset management, and even payroll capabilities.

With Kindful’s QuickBooks integration, users get all the power of QuickBooks accounting combined with Kindful’s intuitive donor database. With a two-way sync between QuickBooks and Kindful, all of your data flows seamlessly between your donor database and your accounting software.

Aplos

Aplos is a cloud-based accounting software solution with high ratings in user-friendliness and has all the features you’d expect from an effective accounting software (activity tracking, asset management, budgeting and forecasting, and more). Its ease of use makes it perfect for organizations that want to jump right in and spend little time on training.

Intacct

Intacct offers users a simple layout and intuitive user experience. For those new to accounting software, Intacct provides training options for all accounting knowledge levels as well as phone and email support services. Some key features of Intacct include accounts receivable/payable, activity tracking, asset management, bank reconciliation, compliance management, partnership accounting, and purchasing and receiving.

NonProfitPlus

Like its competitors, NonProfitPlus gives users all of the basic tools needed for effective accounting. However, it also offers a few nonstandard features such as volunteer tracking and board management.

Bottom Line

Nonprofit accounting is essential to running a successful nonprofit organization. By finding software that meets the needs of your organization, you can accurately record and report every penny donated to your cause, making it easier for you to achieve your financial goals and carry out your mission.

Related Resources

- Accounting Tools article: Nonprofit Accounting

- Capterra article: Best Free Accounting Software For Nonprofits

- Bloomerang Consultants: Nonprofit Accounting Consultant Directory