Major Gifts

What are major gifts?

Major gifts are the largest donations an organization receives from a single source in a single fiscal year. There is no industry standard for how much money counts as a major gift. Each organization must look at their own donation pool and decide what it means to them. For an older, more established organization it may be any gift over $50,000. For a newer, smaller nonprofit it may be a gift of $1,000 or more.

Why do major gifts matter for nonprofits?

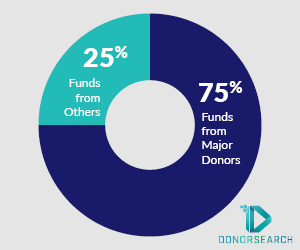

Studies have revealed that on average over 88% of a nonprofit’s funds come from just 12% of donors. This means that major gifts make up the majority of an organization’s total revenue for the year. For most organizations, they are the foundation of their bank accounts. That’s why it’s important to create a fundraising strategy that takes advantage of these funds.

Source: DonorSearch

What are other types of donation gifts?

- Matching Gifts – gifts given by companies that have matched their employees’ contributions to an organization

- General Gifts – gifts of small-to-moderate size given by donors throughout the fiscal year

- Advance Gifts – gifts donors give, or commit to give, before a fundraising campaign has officially been announced

- Cash Gifts – gifts given through a transfer of cash, check, or currency

- Big Gifts – gifts that rank within the upper ranges but are smaller than a major gift

- Planned or Legacy Gifts – big gifts made in someone’s lifetime or at death as part of a donor’s overall financial and/or estate planning

- Non-Cash Gifts – gifts of value that the IRS does not consider cash but can be converted to cash (jewelry, artwork, cars, real estate, etc.)

Bottom line

Major gifts are the largest gifts an organization receives within a single year. Major gifts make up the bulk of a nonprofit’s revenue each year.

Related Resources:

- CFRE: Fundraising Glossary

- Double The Donation post: Corporate Matching Gift Programs

- Planned Giving post: What is Planned Giving?